8 ways to prepare for a baby financially

Whether you make $30k a year or $230k a year, a baby will give you a run for your money. According to CNN Money, the cost of raising a child born in 2013 for 18 years (not including college) is $245,000. This number is up 2% from the year before.

Yikes. That’s a lot of dough.

I’m no expert — heck, I’m not even a financial professional. So, in no way is this financial advice. But here’s what I know. I know that there are practical things that can be done to soften the financial blow of having a baby, and I want to share them with you.

So, here are 8 practical tips for you to get ahead of the game and prepare for your baby.

8 ways to prepare financially for a baby

1. Take financial inventory

Know exactly where you stand financially before you have a baby. See my post onorganizing your financial life for a step-by-step guide.

2. Get your debt under control

If you have a lot of debt before you have a baby, there’s a good chance you’re going to add to it once you have a baby. A good aim is to be debt free with the exception of your mortgage before having a baby. Getting your debt under control will give you financial margin in your life, which leads to peace and a happier home.

3. Build a 6-8 month emergency fund of non-discretionary expenses

By having a 6-8 monthemergency fund, you will feel like you are living within your means and have margin in your life. If you or your spouse is laid off (or you experience any other emergency), your family will be able to live for several months. (Non-discretionary expenses include housing costs, transportation, bills, groceries, etc. – everything except for your taxes, really). To determine the amount of an emergency fund you’ll need, multiply your take home pay by 6-8 and that’s what you should save.

4. Create a baby-fund for miscellaneous baby and mommy expenses

Start saving in a special “baby account” before you have a baby, so you have money for unexpected costs. This money will be useful for pregnancy clothes, additional healthcare costs, such as a c-section (which can cost up to $10,000), and any additional costs the baby brings. Financial preparation will help alleviate stress associated with unexpected issues.

5. Discuss and research daycare

Even before you have a baby, discuss whether you or your spouse plan to stay home with the kids or whether you’ll use daycare. Both options can affect your finances dramatically. Researching your options and having this discussion ahead of time will allow you to prepare for the financial change, which will minimize any related stress.

6. Practice living financially like you already have a baby

Before you have a baby, estimate what you’ll spend monthly on your baby (add “baby” to your budget). Once you have that estimate, live as if you have the baby by putting what you budgeted in a separate account. See how it feels to live that way. You’ll get the best idea of what your financial life will feel like if you do this. And if it’s really tight or unmanageable, you will know this before you have a baby, allowing you to make adjustments and plan more effectively. And whatever you do put away in a separate account while you’re practicing can then be used toward the baby once she arrives.

7. Answer tough questions about school and college

Talk to your spouse about where you want to send your kids to school (public? private?) and even talk about college. It may seem premature to talk about college before your baby is born, but when it comes to the cost of college, I’ve never heard a parent say they started saving too early. Having these discussions and planning ahead of time is really the key to financially being able to pay for your children’s educations.

8. Talk to other new moms

Join groups (whether in person or online) where you can communicate with other new moms for tips and insights. One of the best life hacks is to have a mentor who already is where you want to be. Consider other moms as mentors and absorb all the information from them that you can. You’ll become more prepared in a different kind of way than if you just read books (this applies to any area of your life). The personal communication and connection of mentors adds a unique, valuable element of experience that is irreplaceable.

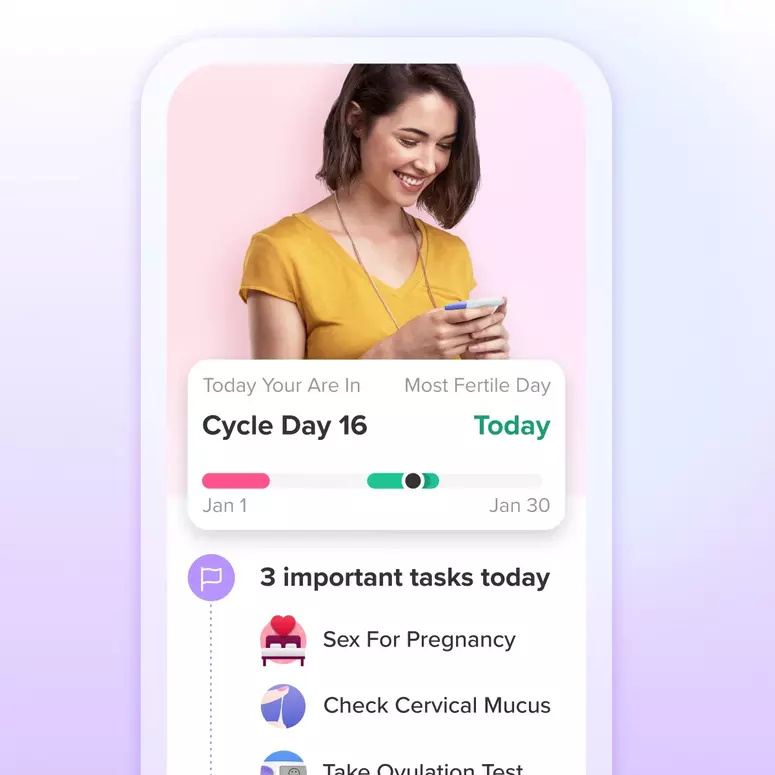

Let's Glow!

Achieve your health goals from period to parenting.