Joint credit card with my mother

This first part is gonna sound pretty pathetic, but I have a credit card that also has my mother’s name on it. The pathetic part is I’m 35 years old. I’ve had it since I was about 13 or 14 when i opened my first bank account by myself (I needed her on it then). I kept it that way all through college and until my adult life. I honestly never even thought anything of it. She recently found out about it and ordered a new card for herself. I had no idea. The limit is $8500. She maxed it out—I didn’t even know because she paid it off in full. Then she maxed it out again this past Sept and didn’t make a single payment on it. That’s how I found out. Fast forward to present day, she’s made 2 payments on it total. My credit has plummeted (801 down to 651). I’m mortified. The account is now suspended. And I don’t want to pay it. I have all my bills on autopay and pay my credit cards off in full every month. We have a great relationship and she’s totally dragging my name thru the mud, in terms of my credit. Im so taken aback that she’s done this and not even showing remorse? She dodges any convo i bring up to her. Is there a tactful way to go about this? I haven’t told my dad because I don’t want him to stress about it and truly i don’t even want my mother to feel bad; I just want it taken care of... Thanks for listening and hit me with any kind and productive ways to approach my mom in order to get her to make a move in the right direction.

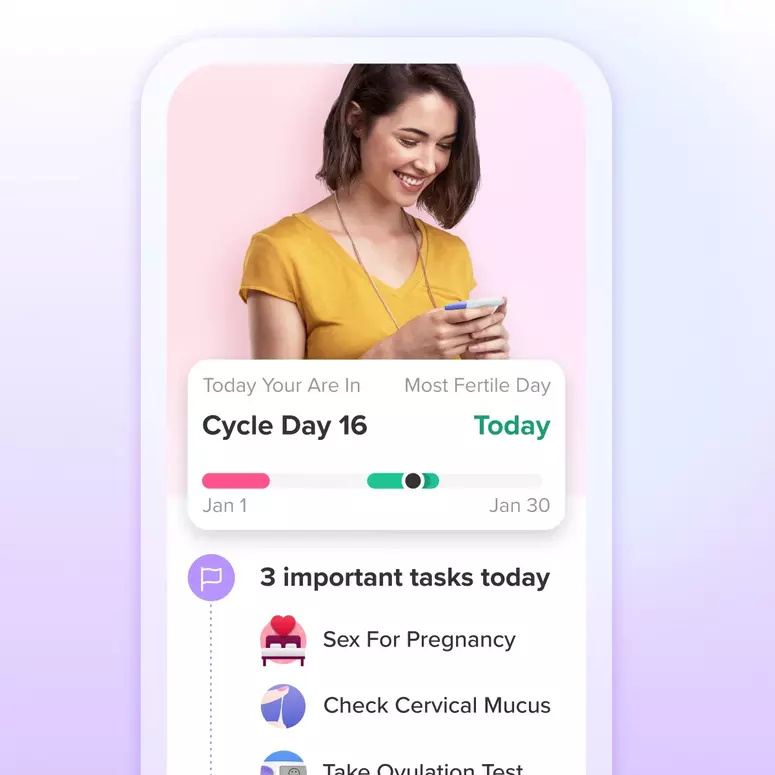

Achieve your health goals from period to parenting.